The residential battery market is rapidly maturing: a handful of high-volume incumbents hold strong brand and distribution advantages, agile challengers push on price and features, and new entrants from automotive and industrial backgrounds are reshaping the field. Below is a mapped-out view of the major competitors — Tesla, BYD, EcoFlow, BLUETTI, and Anker SOLIX — their core strengths, and the market forces likely to determine winners through 2030.

Quick market overview — why this matters

Demand for energy storage across segments is accelerating. Falling cell costs, rising residential adoption, and supportive policies are expanding the market and intensifying competition—opening room for both scale players and specialists.

Tesla — an edge in scale, brand, and software

Standing: A market frontrunner in many Western markets.

Strengths: Tesla leverages strong brand recognition, integrated software and user experience, and scale across procurement, manufacturing, and installation. That combination drives consumer interest, high install volumes, and an ability to push software-enabled services (VPP enrollment, time-of-use optimization).

Risks: Reputation sensitivity, increasing price/feature competition, and heightened regulatory scrutiny.

BYD — vertical integration and manufacturing heft

Standing: A manufacturing giant applying automotive and cell-production capabilities to stationary storage.

Strengths: BYD’s vertical control over cells and modules helps it scale quickly and manage cost. Its modular Battery-Box offerings target both residential and commercial customers with a global footprint.

Risks: Lower brand visibility in some retail markets outside China and the need to build out local installer and support networks.

EcoFlow — fast product innovation and whole-home play

Standing: A nimble innovator evolving from portable power stations toward full home systems.

Strengths: EcoFlow competes with modular, high-power solutions and rapid product cycles. Its focus on modularity and feature-led differentiation (high continuous output, fast install options) positions it well against pricier incumbents.

Risks: Rapid iteration can stress support/supply chains; transitioning to regulated whole-home installs requires new operational capabilities.

BLUETTI — value and modularity for consumers

Standing: Popular in consumer and small-business channels for modular, expandable systems.

Strengths: BLUETTI’s direct-to-consumer approach and emphasis on expandability attract budget-focused buyers who prioritize flexibility and DIY-friendly setups.

Risks: Thin margins from price competition can make after-sales support and warranty fulfillment a challenge compared with larger incumbents.

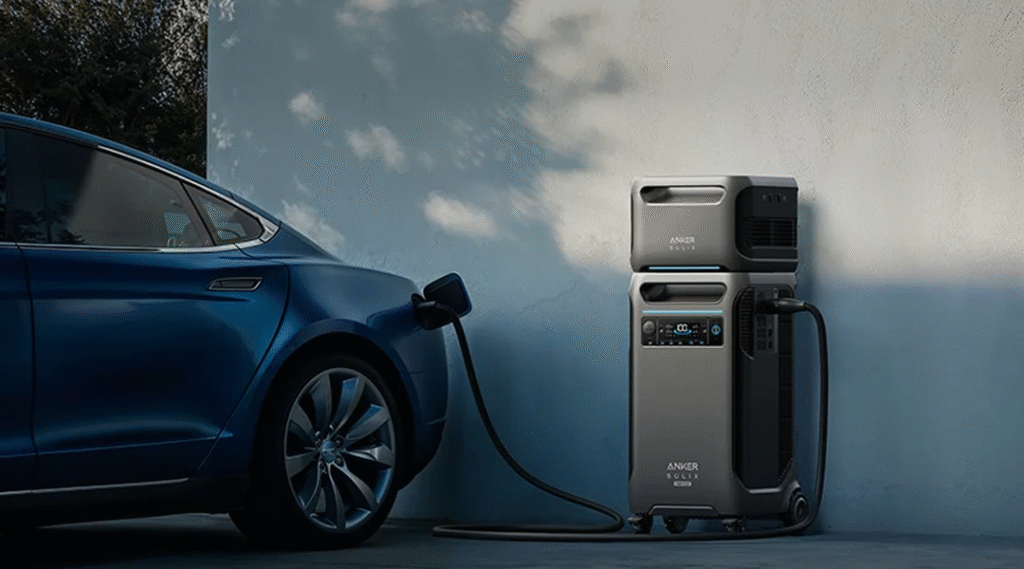

Anker SOLIX — trusted consumer brand moving upscale

Standing: A consumer-electronics brand branching into modular home storage.

Strengths: Anker uses strong retail presence and brand trust to sell SOLIX systems that emphasize safety (often LFP), build quality, and modular capacity. Early reviews indicate strong product credibility.

Risks: Converting consumer-brand goodwill into a robust installer and field-service ecosystem is operationally demanding.

Market dynamics that will shape winners to 2030

- Supply-chain scale / vertical integration: Firms that control cell supply or secure long-term contracts will better protect margins as hardware commoditizes.

- Software & services: Monetizable aggregation (VPPs, managed services) creates recurring revenue and improves customer ROI — a critical edge over hardware-only providers.

- Regulation & local partnerships: Compliance, certified installers, and utility relationships are essential for market access across regions.

- Product differentiation: With LFP more common, buyers focus on power capability, usable kWh, installation speed, warranties, and cybersecurity.

- Channel strategy: Direct/e-commerce favors nimble brands; utility and trade channels favor scale players with integration services.

Strategic takeaways for stakeholders

- Homebuyers: Evaluate total system value (power + usable energy), warranty terms, installer coverage, and software/VPP options.

- Installers / integrators: Partner with manufacturers that supply installer training, spare logistics, and aggregation APIs.

- Investors / OEMs: Favor businesses that combine hardware scale with software-led recurring revenue; expect consolidation and partnership activity.

- Policymakers: Clear interconnection rules and compensation for distributed services will materially influence which players succeed regionally.

Bottom line

Success in the next decade won’t be decided by lowest hardware price alone. The winners will be those who combine safe, reliable hardware (with LFP adoption and strong warranties) with compelling software, aggregation economics, and locally capable installation and service networks. Today Tesla leads on brand and deployments; large manufacturers such as BYD offer manufacturing scale; and challengers like EcoFlow, BLUETTI, and Anker SOLIX push the market on features, modularity, and price. The result will be a larger, more varied, and more service-oriented market by 2030.

All articles for the special edition of home energy storage

(#1) Home Energy Storage 101 : The Foundation of a Smart Energy Future

(#4) From Grid-Tied to Off-Grid: How Home Energy Storage Works with Solar and Smart Homes

(#5) The Economics of Home Energy Storage: ROI, Incentives, and Payback Periods

(#6) Safety and Standards: Building Trust in Home Energy Systems

(#7) The Competitive Landscape of Home Energy Storage: Who Leads Now — and Who’ll Matter by 2030

(#8) Scaling Home Batteries into Critical Power: Data Centers, Microgrids & Emergency Backup

(#10) Future Vision: How Home Energy Storage Will Shape the Next Decade of Smart Living

As for in-depth insight articles about AI tech, please visit our AI Tech Category here.

As for in-depth insight articles about Auto Tech, please visit our Auto Tech Category here.

As for in-depth insight articles about Smart IoT, please visit our Smart IoT Category here.

As for in-depth insight articles about Energy, please visit our Energy Category here.

If you want to save time for high-quality reading, please visit our Editors’ Pick here.