As residential batteries move from niche to mainstream, homeowners are asking a practical question: Will a home battery pay for itself? Batteries promise resilience, lower bills, and cleaner energy, but their financial sense depends on many variables — from local rebates to how your utility prices electricity. Below is a reworded, easy-to-follow guide to estimating ROI, how incentives change the picture, and realistic payback timelines today.

Why the financial case matters now

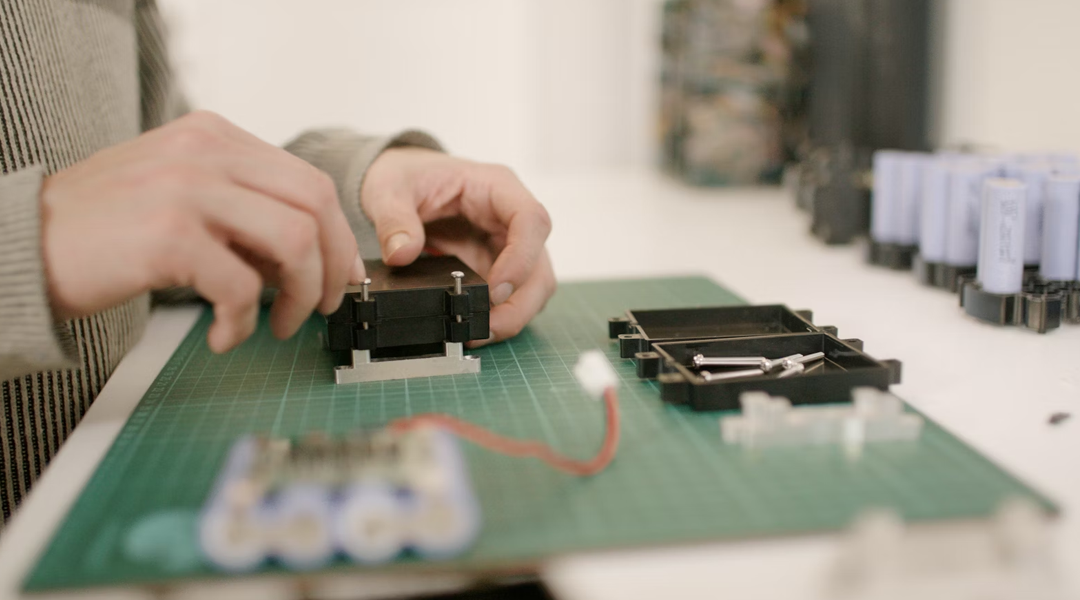

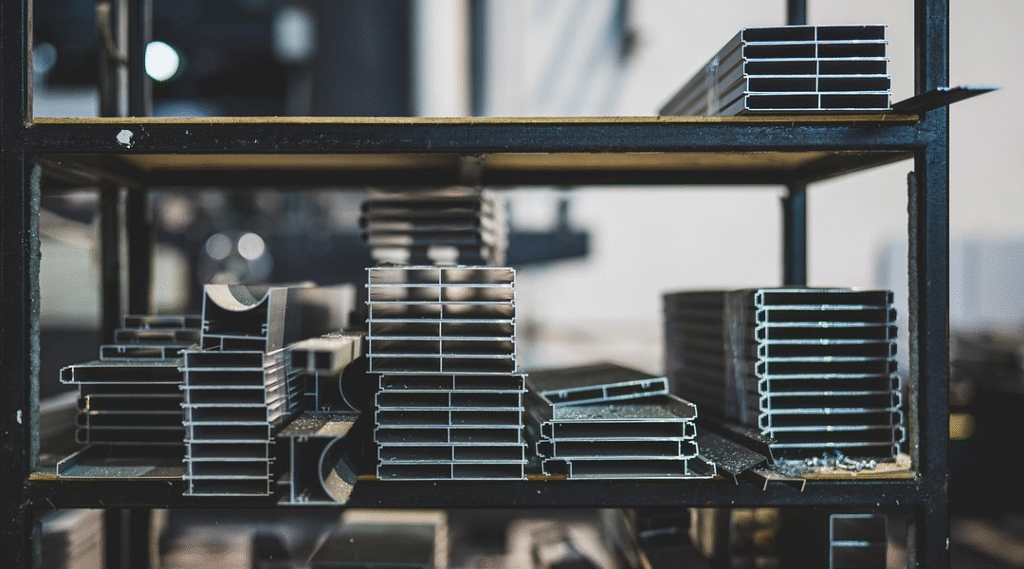

Declining lithium-ion costs, volatile wholesale power prices, and growing rooftop solar adoption are making storage more attractive. In many places, time-of-use rates and grid reliability concerns push batteries from a luxury to a defensible investment. Industry data show residential storage installations expanding rapidly while installed prices drift downward, which makes understanding ROI essential for buyers and installers.

What drives (and destroys) returns

Key variables that determine whether a storage purchase makes financial sense:

- Upfront system cost — hardware, inverter, installation, and possible electrical upgrades. Typical U.S. installs often fall in the $8,000–$16,000 range pre-incentive, depending on size.

- Rate design — TOU and demand charges increase the value of shifting energy; flat rates reduce it.

- Solar pairing — combining storage with PV usually improves economics because you can store surplus generation.

- Backup value — resilience during outages has real but sometimes hard-to-quantify value.

- Incentives and tax credits — these often make the largest single difference in payback timing.

How incentives change the math

U.S. context:

- The Federal ITC now applies to standalone storage (post-2023), effectively 30% off the system price.

- State and local programs (e.g., California SGIP) can deliver additional rebates or performance payments, sometimes another 10–20%.

- Changes to net-metering push more owners toward self-consumption, improving the value of batteries.

International context:

- Several European and Asian markets offer subsidies, low-interest loans, or feed-in/aggregation payments that improve returns.

When incentives apply, typical payback windows can tighten substantially — for some projects moving from ~10–12 years down to 6–7 years or better.

A simple ROI / payback model

Useful formulas:

Annual Savings=(Energy shifted×Rate difference)+Program payments+Outage-avoided costs

Payback Period=Annual Savings/Net System Cost

Illustration:

A 13.5 kWh battery paired with solar costs $12,000 after incentives. If you shift ~8 kWh/day from peak to cheaper hours at a $0.30/kWh differential, that’s $2.40/day → roughly $876/year. Add $150/year from a VPP and $200/year in avoided outage losses → ~$1,226/year, giving a ~10-year payback and an annualized return in the mid single digits — before considering home-value effects or non-monetary benefits.

Additional revenue opportunities

Beyond direct bill savings, storage can be monetized:

- VPP programs — aggregated batteries provide grid services and often pay participants $100–$500/year.

- Dynamic pricing & demand-response — advanced control can capture high wholesale prices.

- Resilience premiums — in some areas, the practical value of backup (insurance, business continuity) can exceed straightforward bill savings.

Common mistakes and risks

- Counting on full daily cycling: Real-world use is often less aggressive than theoretical models.

- Neglecting degradation: Battery capacity fades over time; warranties usually cover 10 years or a set cycle count.

- Overlooking software and warranty terms: Poor monitoring or weak warranty language undermines expected performance.

- Financing costs: Loans and interest increase total cost and can lengthen payback if not offset by incentives.

How to maximize returns

- Right-size your system: Avoid oversized systems—match capacity to typical daily needs.

- Optimize TOU cycles: Discharge during peak-price windows for maximum savings.

- Integrate smart controls and automation: Automation raises utilization and reduces user error.

- Join VPPs where available: They can add measurable, recurring income.

- Maintain firmware/inverter updates: Software upgrades can unlock better performance or program access.

Where the market is headed

By 2030, home batteries are likely to function more like active grid assets than passive backups. Households aggregated into flexibility markets could earn meaningful annual income — analysts suggest participating homes might see $500–$800/year in some markets — which would compress payback periods to around five years in favorable scenarios.

The right incentives, smart sizing, and participation

Home batteries have moved from a niche upgrade to a credible economic option in many regions. With the right incentives, smart sizing, and participation in grid programs, paybacks can fall into the 5–10 year range. The best outcomes combine thoughtful sizing, available financial incentives, and software-enabled participation — delivering resilience, emissions reductions, and measurable financial returns.

All articles for the special edition of home energy storage

(#1) Home Energy Storage 101 : The Foundation of a Smart Energy Future

(#4) From Grid-Tied to Off-Grid: How Home Energy Storage Works with Solar and Smart Homes

(#5) The Economics of Home Energy Storage: ROI, Incentives, and Payback Periods

(#6) Safety and Standards: Building Trust in Home Energy Systems

(#7) The Competitive Landscape of Home Energy Storage: Who Leads Now — and Who’ll Matter by 2030

(#8) Scaling Home Batteries into Critical Power: Data Centers, Microgrids & Emergency Backup

(#10) Future Vision: How Home Energy Storage Will Shape the Next Decade of Smart Living

As for in-depth insight articles about AI tech, please visit our AI Tech Category here.

As for in-depth insight articles about Auto Tech, please visit our Auto Tech Category here.

As for in-depth insight articles about Smart IoT, please visit our Smart IoT Category here.

As for in-depth insight articles about Energy, please visit our Energy Category here.

If you want to save time for high-quality reading, please visit our Editors’ Pick here.